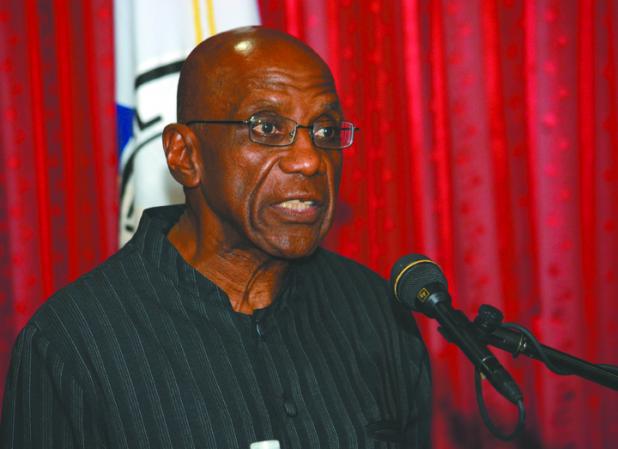

Former Central Bank of Barbados Governor, Dr. Delisle Worrell.

BUSINESS MONDAY: GROWING TAX BURDEN

THE tax burden on Barbadians continues to increase and the Government, through its borrowings, has emerged as the second most important source of foreign inflows.

These are some of the points raised by former Central Bank of Barbados (CBB) Governor, Dr. Delisle Worrell.

He was at the time analysing the performance of the Barbados economy during the first quarter of 2021.

Using CBB charts to assess how the economy performed, Dr. Worrell, who is an international consultant, said that compared to 2017/2018, the tax burden in Barbados in 2020/2021 was 1.5 points of GDP, whereas expenditure was two two points higher.

The tax burden gives a breakdown of the level of taxes a government imposes on a country.

It does not include non- tax revenue.

According to Dr. Worrell, other charts in the presentation show that:

Foreign reserves fell $86m in the first quarter (of 2021), the first downturn since 2017;

The debt/GDP ratio at March was five points higher than at the end of 2017;

The servicing of external debt absorbed 12 per cent of foreign earnings;

He also said that the deficit was five per cent of GDP in first quarter, almost the same as for the 2020/21 fiscal year.

As for foreign inflows, he said the foreign borrowings by government up to last year were five percentage points above those of 2018.

The charts show Government foreign borrowing provided 77 per cent of the foreign reserves accumulation in 2018, 81 per cent in 2019 and 82 per cent in 2020;

Tourist earnings provided 24 per cent of foreign exchange inflows; Government borrowing was the second most important source of foreign exchange inflows, at 20 per cent;

Payments for services from abroad far outweigh the amount of FX received from the international business and financial sector;

In 2020 Government borrowing contributed almost twice as much to FX inflows as did foreign direct investment;

There was a 27% drop in VAT receipts in FY2020/21; company taxes almost doubled;

The valued added tax (VAT) provides one-third of Government revenues, twice the contribution of the income tax;

Wages and grants to state enterprises and UWI together take half of Government’s spending;

Domestic interest payments have been cut drastically, and subsidies less so, but the wages bill is slightly higher than it was in 2017.