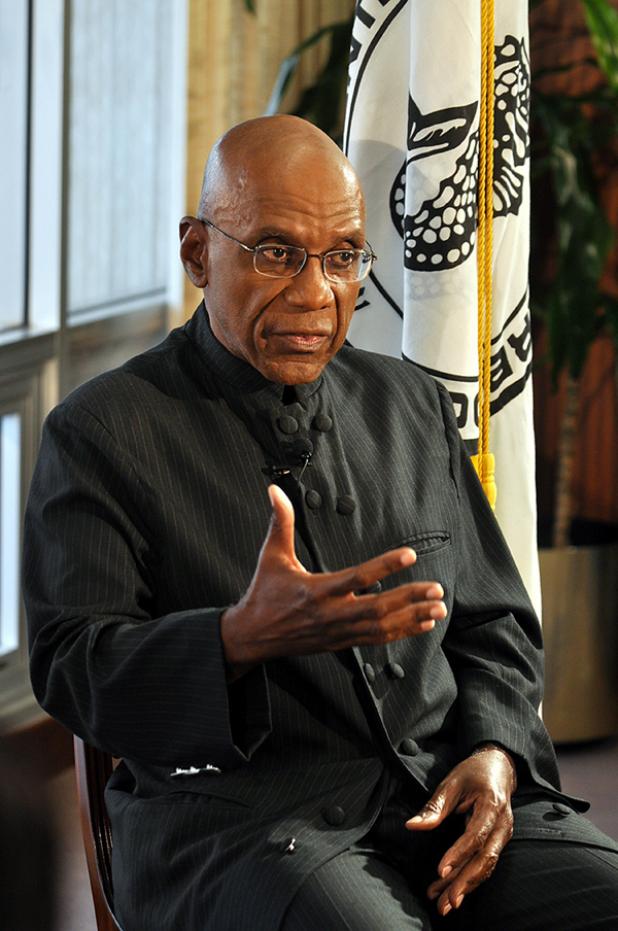

Former Governor of the Central Bank of Barbados, Dr. Delisle Worrell.

BUSINESS MONDAY: blow to economy

FORMER Governor of the Central Bank of Barbados, Dr. Delisle Worrell, has portrayed some damaging effects on the local economy from the Budget which Finance Minister, Christopher Sinckler, presented last May.

Dr. Worrell, who was sacked as Governor earlier this year, sees some shortfall in the proposed revenues from the controversial National Social Responsibility Levy (NSRL) and the two per cent commission on the sale of foreign exchange.

He is also predicting that economic growth will contract further in 2017, accompanied by further declines in the country’s international reserves.

Last Friday, Dr. Worrell released a paper which discussed in a comprehensive way the present status of the Barbados economy, and among other things the Budget of May 2017; while also calling for the sacking of 4 500 public officers over a three-year period; and advising Government to seek some $270 million from the International Monetary Fund to compensate those who will be losing their jobs.

Dr. Worrell, who has been heavily criticised for the latter, said the NSRL will not yield the anticipated revenues.

“My estimate of the maximum yield for the NSRL and the foreign exchange fee is about $330 million, taking into the fact that the taxes will cause a rise in prices which will reduce the purchasing power of national incomes,” he said.

“This will result in a reduction of spending on consumer durables such as motor cars and discretionary items,” the former Governor declared. He further stated that some investments may also be postponed.

Said Dr. Worrell: “Taking account of these effects reduces the expected income from the new taxes. My estimated yield of the taxes, which is about 3.5 per cent of GDP, is a considerable loss of the disposable income of taxpayers, and it will impact businesses in the retail sector and those who provide personal and business services.”

As a result, he went on to note that the overall impact on the economy could be to cause a contraction of overall output of three per cent in 2017. There will also be a further loss of foreign reserves in 2017 of about $36 million, he predicted.

The economist added that the public sector remains a drag on the economy. He therefore reasoned that increasing taxes without addressing low and falling productivity in the public sector, transfers resources from the more productive private sector to the less productive private sector. This, according to him, is exactly the “opposite of what is required for the competitiveness and growth of the economy”.

He charged that external funding sources are all closed because of government’s poor credit rating and the policy decisions not to seek financial support from the IMF.

“In the absence of IMF support for the fiscal programme, access to support from other international financial institutions is very limited. The loss of confidence by banks, mutual funds and other domestic investors means there is not much support to be had from that quarter,” said the ex-Governor.

He added that it follows that financing a deficit of this magnitude would have fallen on the Central Bank, and that the resultant money creation would have reduced foreign reserves to unacceptably low levels. (JB)