NO TAX EASE

THERE is no ease when it comes to the tax burden Barbadians are facing.

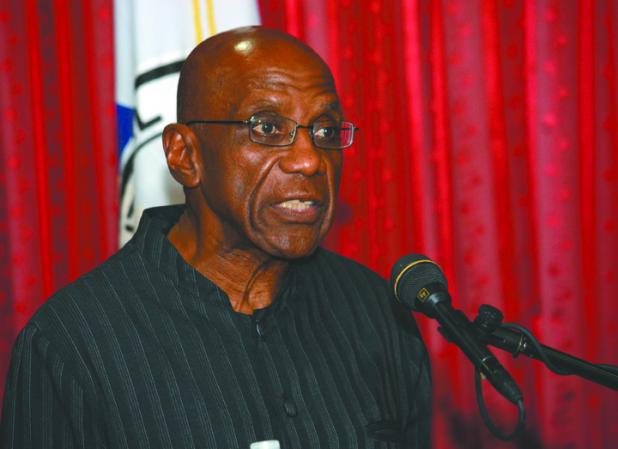

That’s according to former Governor of the Central Bank of Barbados, Dr. Delisle Worrell who has painted a bleak picture of government services and their contribution to economic output in the country.

The former Governor gave an assessment of the local economy which is into the second of a four-year agreement with the International Monetary Fund (IMF).

He said in the assessment that the tax burden on Barbadians continues to increase.

According to him, Government revenues absorbed 29 per cent of GDP for the fiscal year ended march 2019.

He stated further that Government’s current expenditure has been cut by $515 million in the April to December 2019 period, compared to two years earlier.

“Eighty per cent of the reduction, $418 million, was in interest income lost as a result of debt restructuring. Those suffering income losses included pensioners, insurance companies, credit unions, the National Insurance Scheme, commercial banks and other holders of Barbados Government debt, at home and abroad,” he maintained.

The ex Governor also remarked that Government services have added less to economic output every year for the six years of data provided by the Central Bank.

He commented that while government spending on maintenance, construction of buildings, roads and facilities, acquisition of equipment and machinery and other capital expenditure reached a low point in 2018/2019 fiscal year, current spending has not yet recovered to the level of 2017/2018.

Except for the tourism industry all other areas of the Barbados economy declined in 2019, Dr. Worrell explained.

“Tourism was the only growth sector in 2019,” recalled Dr. Worrell, noting further that its contribution to real output has grown steadily over the last five years.

“Finance and other services, which includes banking, insurance and international business and financial services, has stagnated since 2017,” said the Economist.

He stated also that, “Distribution, transport and communications, and manufacturing are all in decline.”

Dr. Worrell indicated that Tourism receipts provided two-thirds of foreign exchange inflows, with domestic exports contributing another 13 per cent. Foreign investment inflows and Government borrowing from the IMF, the Inter American Development Bank and the Caribbean Development Bank provided ten per cent each.

“Rum, processed food, chemicals and construction materials were the most significant exports, each contribution two per cent of foreign currency inflows. Sugar’s contribution was 0.03 per cent,” he stated.

In the assessment, Dr. Worrell pointed out that outflows of foreign exchange for services were greater than foreign exchange inflows for international business and other foreign earnings from services (other than tourism). “Outflows of income and transfers also exceeded inflows under those headings,” he remarked.