BUSINESS MONDAY: Barbados’ external commercial debt deal examined

THE agreement which Barbados reached with external creditors has given the country some reprieve for loans that would have matured in 2019 through 2022, says a regional Economist.

However, Dr. Juliet Melville believes that the agreement reduces considerably the time frame for the repayment of a $380 million bond, originally due in 2035.

Dr. Melville is a former Chief Economist at the Caribbean Development Bank, and a former Lecturer in the Economics Department at the University of the West Indies, St. Augustine, Trinidad and Tobago.

She analysed the agreement and shared a copy of her analysis with this newspaper:

“The announced deal with the External Creditor Committee is welcomed, since the restructured domestic debt was identified as a critical element of the Barbados Economic Recovery and Transformation (BERT) Plan.

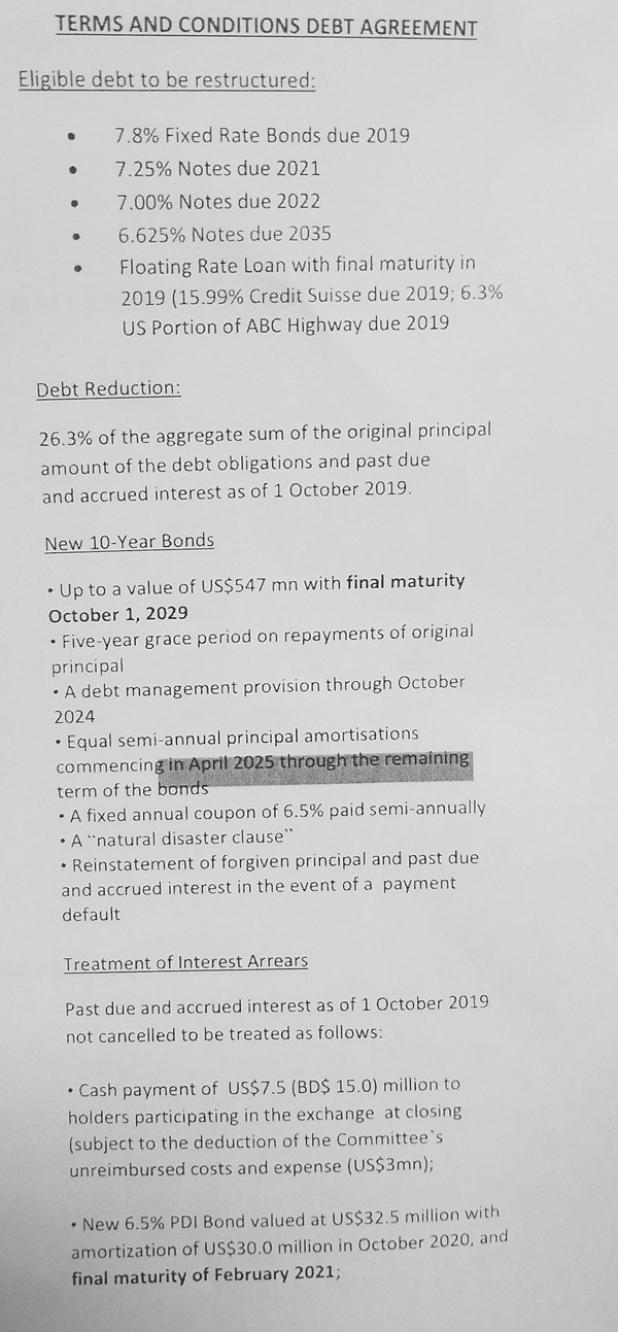

The press release of October 18, 2019 sets out the key terms of the agreement reached in principle (See Box).

“The resolution presented in Parliament on October 29, 2019 and ensuing debate on the Debt Holder (Approval of Debt Restructuring) (Validation) Resolution provided greater clarity. Two new bonds to the value of US$547.0 million and US$32.5 million will be issued to replace the restructured debt. How was this figure arrived at? What volume of debt will be affected? What savings will be achieved? What volume of external debt is still to be restructured. Given the public interest in the subject, an attempt is made to offer some answers.

“The first thing to note is that the deal specifically treats with external commercial loans (US dollar denominated debt) as distinct from other US Dollar loans with international organisations such as the IDB, CDB, and CAF, referred to as Official Creditors.

It is standard practice that these latter loans are excluded from debt restructuring. Based on the latest publicly available data provided to creditors on the BGIS website, it is estimated that that as at October 1, 2019, the total US denominated commercial and bilateral debt was Bds$1.87 billion. The deal covers Bds$1.29 billion (or 71 per cent) of the debt plus $176.9 million in past due and accrued interest (PADI) giving a total of approximately $1.5 billion in outstanding principal and accumulated interest. This estimate includes the outstanding balance on the Credit Suisse Loan ($184.3 million) and the US $ portion of the ABC Highway Loan ($12.9 million) maturing in 2019 together with the four loans identified in the press release.

“The Government has been able to negotiate a 26.3 per cent reduction in nominal debt service payment – leaving $953.90 million and $130.4 million in outstanding principal and interest, respectively to be repaid.

“The finalisation of agreement will see the outstanding interest settles with an immediate cash payment of $9.0 million (The US$7.5 to be paid on signing comprises US$3.0 million in fees for Creditors Committee, hence only US$4.5 million is treated as interest payment) and the issue of a 16-month bond for another $65.0 million (US$32.5 million) with a 6.5 per cent coupon maturing in 2021. The remaining interest ($56.75 million) together with the reduced principal ($953.90 million) totals just over $1.0 billion (US$500 million) to be refinanced with a new 10-year bond. Using the figure of $1.0 billion, post-debt restructuring, that is, after the debt write-off, capitalisation of past due interest and the issue of the new 2021 and 2029 bonds, the restructured external commercial debt stock is estimated to decline by $219 million (17 per cent) and interest payment on this by $201 million (28 per cent), giving an overall decline in total nominal debt service payment for this stock of restructured debt of $420 million (21 per cent).”

The Economist said that the repayment of the 2021 Past Due and Accrued Interest (PADI) Bond will begin next year with a $60 million pay down of principal.

The PADI refers to the deal which covers $1.29 billion or 71 per cent of this debt plus $176.9 million in PADI giving a total of approximately $1.5 billion in outstanding principal and interest.

“Repayment of the new 2029 bond of approximately $200 million starts in 2025 to be fully paid by October 1, 2029,” she said in the note to Business Monday.

“Interest payment resumes immediately with a payout of $15.0 million 2019, $100 million in 2020 and around $65 million annually to 2024 declining thereafter as principal payments starts,” the Economist explained.

Dr. Melville said too that the weighted average interest on the restructured commercial external debt percentage, including the 16 per cent Credit Suisse loan, is 8.2 per cent compared to the 6.5 per cent on the new bonds.

“Given the different maturity profile and coupon, to really assess the true debt relief from the agreement, the present value of the stream of payments associated with the new bonds needs to be compared with present value of the stream of payments of the retiring instruments,” the official remarked.

According to her, “This will take account of the time value of money, that is, the fact that a dollar today is worth more than a dollar received in the future. Additionally, the cost associated with negotiating this restructuring agreement would also have to be taken into account.”

She is of the belief too that the implications for the agreed targets with the International Monetary Fund (IMF) have not been addressed.

What is known, Dr. Melville pointed out, is that the agreement falls short of the 37 per cent write down of principal and the significant lengthening of maturity, which were being sought in the proposals put to creditors in June 2019 for “a new Amortising Step-Up Notes due 2033 (issued at a 37 per cent discount to face value), or for new 3.25 per cent Amortising notes due 2044 (issued at par)”.

With the restructuring, Barbados’ external commercial debt will stand at Bds$1.0 billion with interest due of $522.0 million to 2029.